Tax On Social Security Benefits 2024

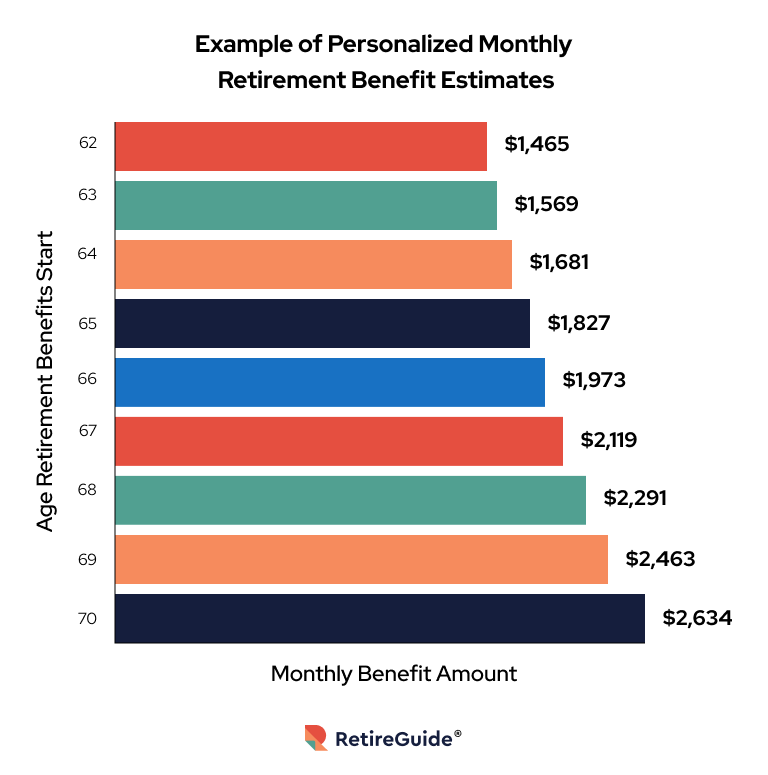

Tax On Social Security Benefits 2024. Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit.

Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Assessment of social security payroll taxes on incomes of.

The Bill Contains Two Main Provisions:

More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi) payments in 2024.

Social Security Payments Are Subject To Federal Income Tax In 2024, But Only If Combined Income Exceeds Certain Limits.

Missouri is the most recent state to drop income tax on social security benefits, with a bill signed into.

The Good News Is That Social Security Income Is Taxed Less Than Other Forms Of Retirement Income.

Images References :

Source: sheaqcorabel.pages.dev

Source: sheaqcorabel.pages.dev

2024 Maximum Social Security Taxable Maire Roxanne, The states that will not tax social security benefits in 2024. Regardless of how much you make in retirement, at least 15% of.

Source: vaniaqodilia.pages.dev

Source: vaniaqodilia.pages.dev

What Is The Social Security Tax Rate For 2024 Madge Rosella, File a federal tax return as an individual and your combined income* is. Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act.

Source: mybusinesswebspace.com

Source: mybusinesswebspace.com

Taxing Social Security These 11 States Will Tax Your Social Security, Colorado, connecticut, kansas, minnesota, montana, nebraska, new mexico, rhode island, utah and vermont. As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the.

Source: www.thanksalattehollysprings.com

Source: www.thanksalattehollysprings.com

10 States That Will Tax Social Security Benefits in 2024 Thanks a, Social security benefits are primarily funded by a 12.4 percent tax on most workers’ incomes. You can ask us to withhold federal taxes from your social security benefit payment when you first apply.

Source: www.covisum.com

Source: www.covisum.com

Taxable Social Security Calculator, If you have a job, you pay half of that rate (via fica withholding from. For 2024 that limit is $22,320.

Source: danielewsusie.pages.dev

Source: danielewsusie.pages.dev

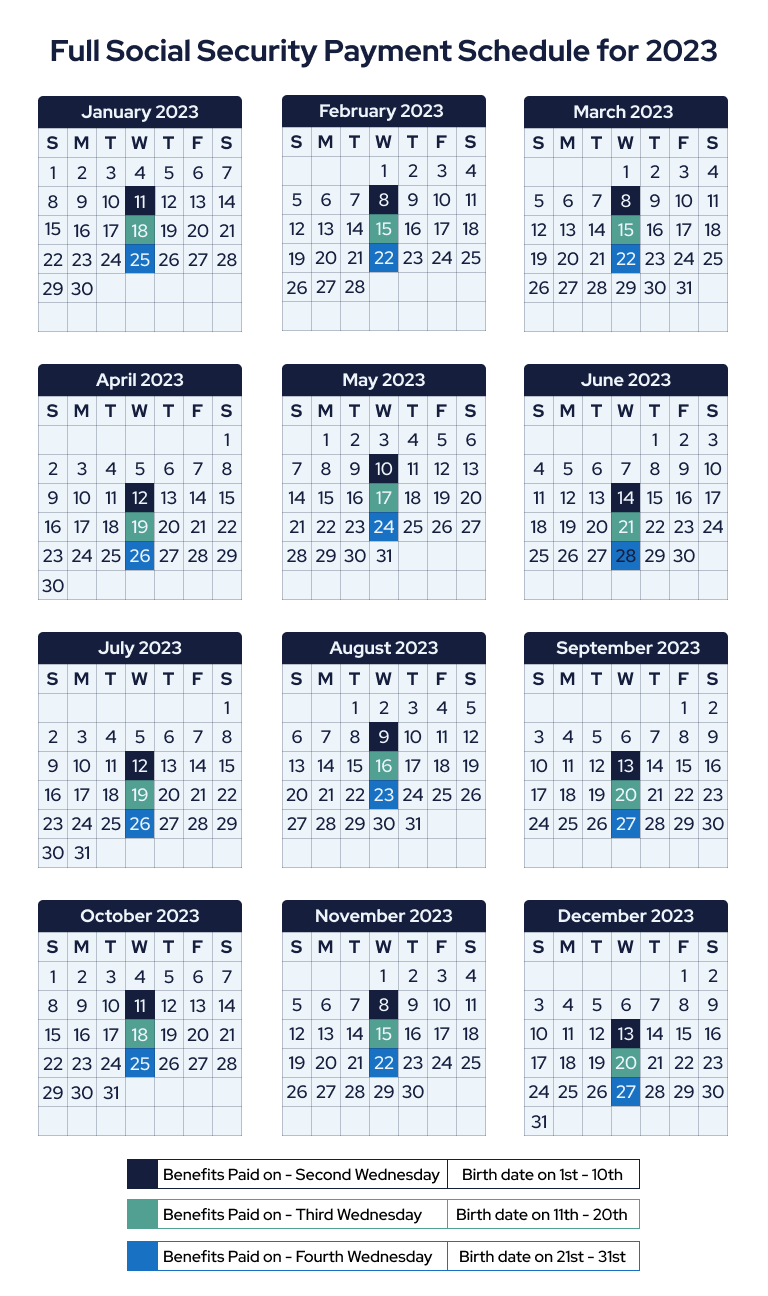

2024 Social Security Benefit Payment Calendar Olwen Michal, Social security benefits are primarily funded by a 12.4 percent tax on most workers’ incomes. If you have a job, you pay half of that rate (via fica withholding from.

Source: www.youtube.com

Source: www.youtube.com

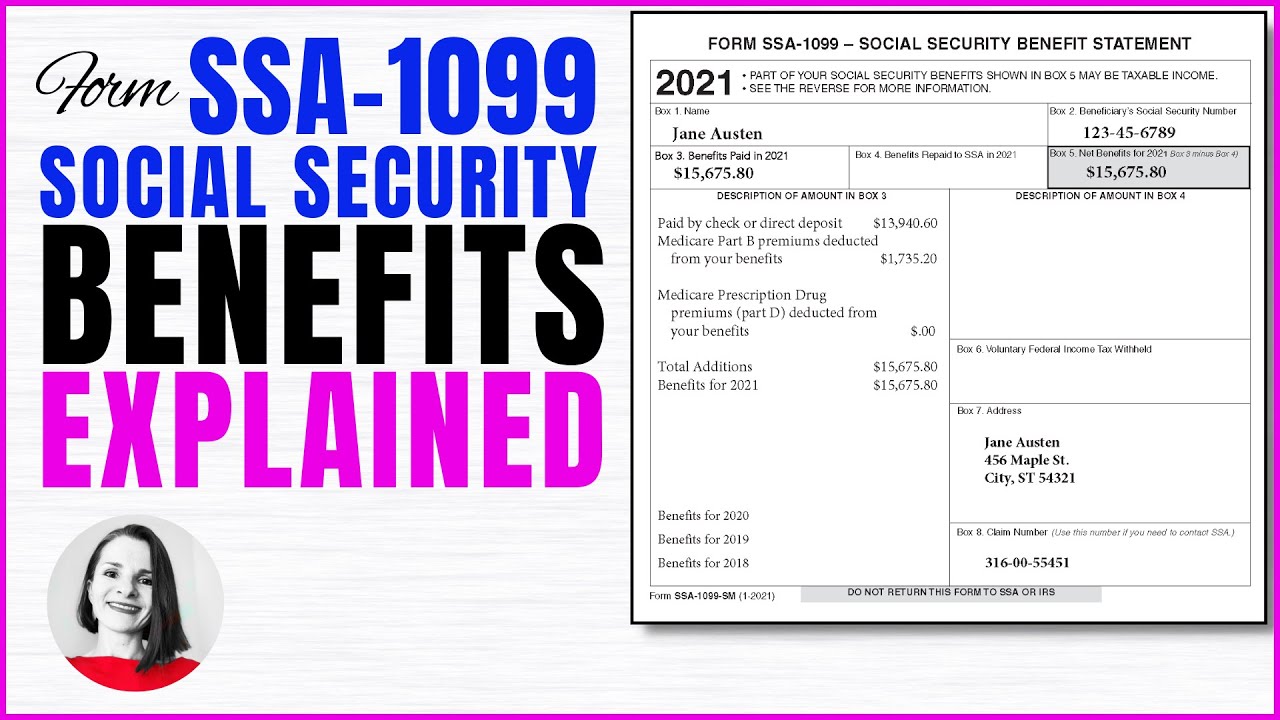

Tax Form SSA1099 Social Security Benefit Explained Is My Social, Missouri and nebraska passed tax exemptions for social security income, meaning there are now just 10 states that tax the benefits. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year.

Source: cristalwcharla.pages.dev

Source: cristalwcharla.pages.dev

Social Security Taxable Benefits Worksheet 2024 Cris Michal, Missouri and nebraska passed tax exemptions for social security income, meaning there are now just 10 states that tax the benefits. As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the.

Source: margarettewcordie.pages.dev

Source: margarettewcordie.pages.dev

Social Security Tax Brackets 2024 Hedi Raeann, You will pay tax on your social security benefits based on internal revenue service (irs) rules if you: The average benefit for an individual is $698.

Source: berrieqkarlee.pages.dev

Source: berrieqkarlee.pages.dev

Max Ss Benefit 2024 Kyle Shandy, As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi) payments in 2024.

Up To 85% Of Your Social Security Benefits Are Taxable If:

Missouri and nebraska passed tax exemptions for social security income, meaning there are now just 10 states that tax the benefits.

Regardless Of How Much You Make In Retirement, At Least 15% Of.

The states that will not tax social security benefits in 2024.